Sprott Physical Gold Trust – own paper or physical gold

Photo: Can Stock

Photo: Can Stock

The Sprott Physical Gold Trust (“The Trust”) ticker symbol: PHYS (NYSE Arca) is a closed-end mutual fund trust registered in Canada. The Trust invests in long-term holdings of unencumbered, fully allocated, physical gold bullion. It does not make regular cash distributions to its unit holders.

Advantages to investing in PHYS:

- Units may be redeemed for physical gold bullion

- Get favorable tax treatment if you hold the units more than one year

- The Trust only invests in gold bullion which is fully allocated

- The gold bullion is stored at a location outside the USA.

The Trust holds its allocated gold bullion assets in the custody at a Federal Crown Corporation of the Government of Canada. There is no levered financial institution between the unit holders and the Trust’s physical gold, and no risk of financial loss in the event of a bankruptcy or nationalization of the financial institution.

Investors have the ability to redeem their units for Physical Gold Bullion. According to the asset manager, the gold custodian can deliver the bars almost anywhere in the world via an Armoured Transportation Service Carrier. Physical redemptions will never dilute the remaining unit holders. The Trust invests exclusively in London Good Delivery physical gold bullion.

US non-corporate investors who hold units for one year or more and file a timely QEF form and realize gains on the sale of their units, pay capital gains tax at 15% (20% for married filers earning over $450,000 and single filers earning over $400,000 per year). For more detailed tax guidance information Sprott tax guide. The Trust is classified as a “Passive Foreign Investment Company” for US tax purposes.

For investors, the Trust units would be best held outside an IRA in order to take advantage of the favorable tax treatment of capital gains.

Studies have shown that by diversifying into gold, an investor can increase his risk-adjusted returns

Some key statistics of PHYS as at October 27, 2017:

| Fund family | Sprott Asset Management LP |

| Inception date | February 26, 2010 |

| Underlying Index | London Good Delivery Bars |

| Assets under management | $2,211,679,800 |

| Share outstanding | 212,866,000 |

| Management fee | 0.35% |

| Average volume | 403,633 |

| 52-week price range | $9.19 - $11.02 |

PHYS is a good fit for the retail investor. It allows the investor to redeem his units into gold bullion, all the gold is allocated and stored in a vault outside the USA. The Trust is classified for US tax purposes as a “PFIC” – “Passive Foreign Investment Company” and it allows the investor favorable tax treatment of any gains.

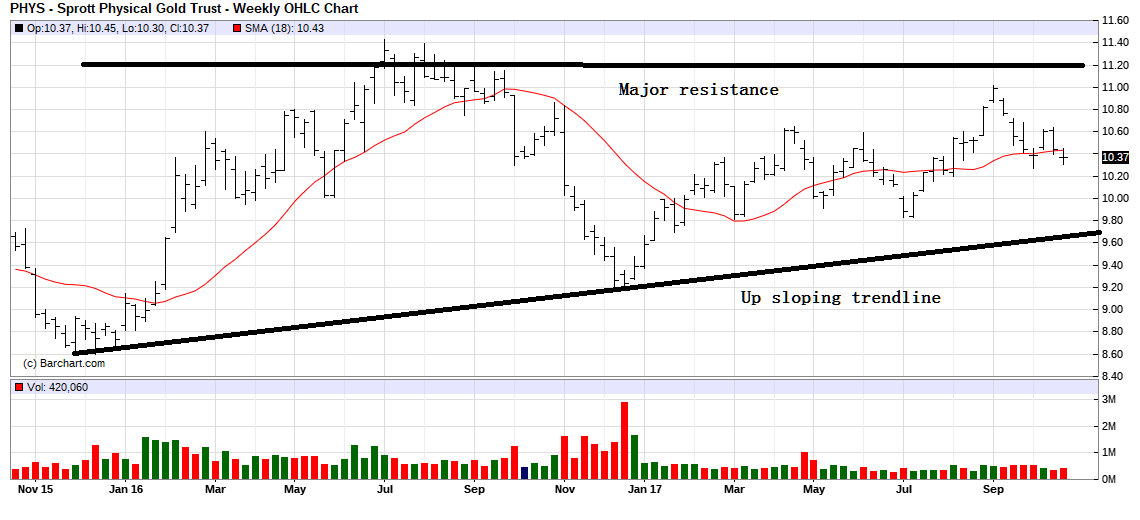

Below is a price chart of PHYS. The price patterns are similar to that of cash gold chart which is shown below it.

Weekly price chart of PHYS for WE October 27, 2017

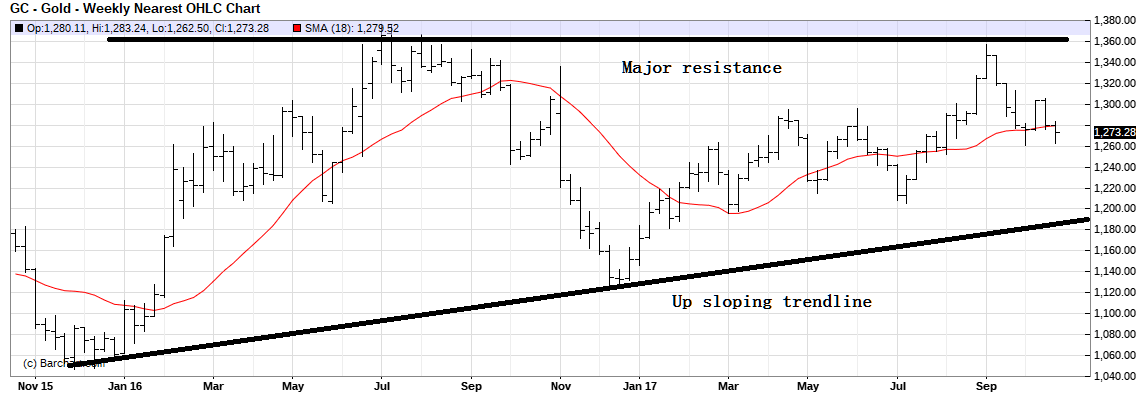

Weekly cash gold chart for WE October 27, 2017