A Good Case for buying Gold

Investors consider three factors in deciding where to invest their funds:

- Safety of Capital

- Liquidity

- Rate of return

The first two factors are paramount before considering the rate return on capital. Investors usually start off by investing in high-quality, liquid assets such as term deposits, government bonds, GIC, etc.

In times of financial crisis, gold has outperformed other high-quality liquid assets including US Treasuries, Japanese government bonds, German Bonds and UK gilts.

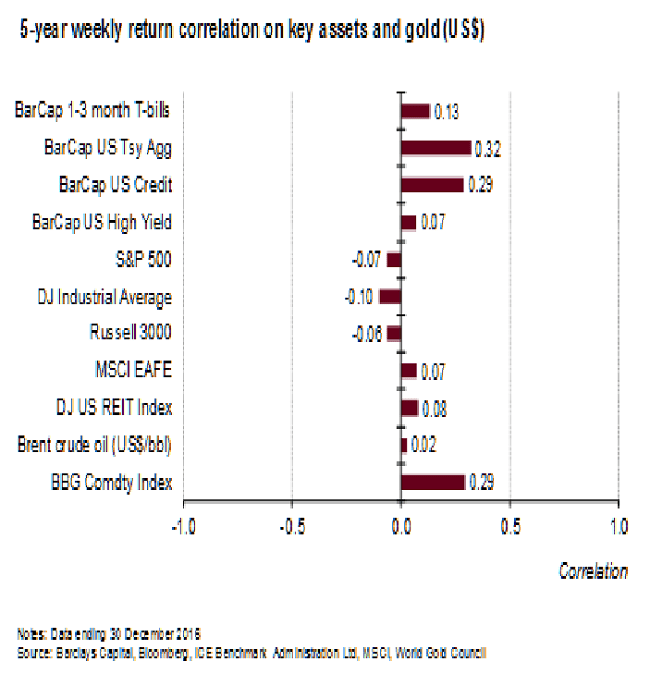

Gold historically has a low correlation with other financial assets. This makes it effective as a portfolio diversifier, thereby reducing inherent risk and volatility. Gold’s low correlation to other financial assets is due to the diversity of demand.

Gold has a wide range of buyers and sellers who have different motivations under different economic conditions.

Examples of different types of buyers are:

- Indian jewellery manufacturers

- Electronics producers in Asia

- Global pension and endowment funds

- Central banks

- Gold purchasers in India and China

This diversity of demand coupled with a stable and slowly growing supply, means that gold has a low correlation with other assets. Gold is an ideal portfolio diversifier.

Risk mitigation:

Gold helps mitigate specific risks in a portfolio, namely credit risk, duration or interest rate risk and currency risk. Physical gold has no credit risk. It does NOT constitute an obligation of a government or issuer. Gold does not carry any interest rate risk and it could also be used as collateral for loans. This only applies to gold that is held outside the IRA. Gold acts as a store of value in countries with volatile foreign exchange rates. For more details on gold demand see table.

Liquidity:

A market is highly liquid if it is large, has high daily volumes, low transactional costs and universally accepted. The gold market has strong trading volumes amongst bullion dealers active in the over-the-counter market (“OTC”). The London Bullion Market Association (LBMA) which represents bullion dealers in the OTC market estimates that the average daily volume of gold transferred from one loco to another is about US$25 bn. Gold is universally accepted as a means of payment by governments.

Return:

Since 1997, the average annual return on gold in US dollar terms, has consistently outperformed the average returns on US treasuries, Eurobonds, Japanese government bonds and UK gilts over 10-year, 5-year and 1-year time horizons. For a comparison of gold returns compared to other indexes see table.

Source: World Gold Council

Thinking of investing in gold in or outside your IRA:

Physicial gold products are available in a variety of weights. Bars are commonly purchased at 1 kg or less for private investment.

The kilobar is the world’s most widely manufactured and traded small bar – popular among jewellery makers and investors as they are traded at a low premium.

Well known official gold coins are:

- South African Krugerrand

- USA American Eagle

- Canadian Maple Leaf

- UK Britannia

Source: World Gold Council