Royalty Gold Companies – a superior cash flow business

Photo – Can Stock

There are several ways to invest in gold:

- Gold coins or bullion

- ETFs

- Options to purchase gold mining company shares

- Royalty gold companies

Royalty gold companies provide financing to mine operators for the development and construction of a mine, mine expansion or funding for exploration work. In return for the capital, the royalty company collects either a stream or royalty payments for a set period.

A stream is the right to purchase a percentage of the gold produced from the mine at an agreed upon price. A royalty is the right to receive portion of the revenue generated from the mine.

Royalty gold companies provide a unique and lower risk investment opportunity for the investor. By buying revenue streams and royalties, royalty companies do not carry the risks associated with running a gold mine. The mine operator has to deal with political stability in foreign countries, employment issues with labour force, risk of bankruptcy, cash flow management, costs associated with setting up the infrastructure of the mine, costs of managing the day to day operations of the mine, etc. Royal gold companies are solely responsible for providing the finance and once the stream/ royalty agreements are signed, collect the revenue in terms of the agreements. Usually, royalty gold companies do not have to contribute further capital to a particular project. This caps the companies investment with a known rate of return. The return will vary depending on the price of gold. However, projects are made to ensure that a minimum rate of return is obtained.

Since the capital contribution is fixed on each project and the revenue is limited to an agreed upon amount, the only way for a royal gold company to expand is to buy or invest in as many mining projects that it can afford.

The following table lists the main royalty gold companies.

| Company Name | Ticker Symbol | Exchange | 52 week range |

|---|---|---|---|

| Franco Nevada Corp. | FNV | NYSE | $53 - $86 |

| Wheaton Precious Metals | WPM | NYSE | $17 - $23 |

| Royal Gold Inc. | RGLD | NASDAQ | $60 - $94 |

| Sandstorm Gold Inc. | SAND | AMEX | $3 - $5 |

| Osisko Gold Royalties Ltd. | OR | NYSE | $8 - $14 |

Below are weekly price charts for the companies listed in the table above.

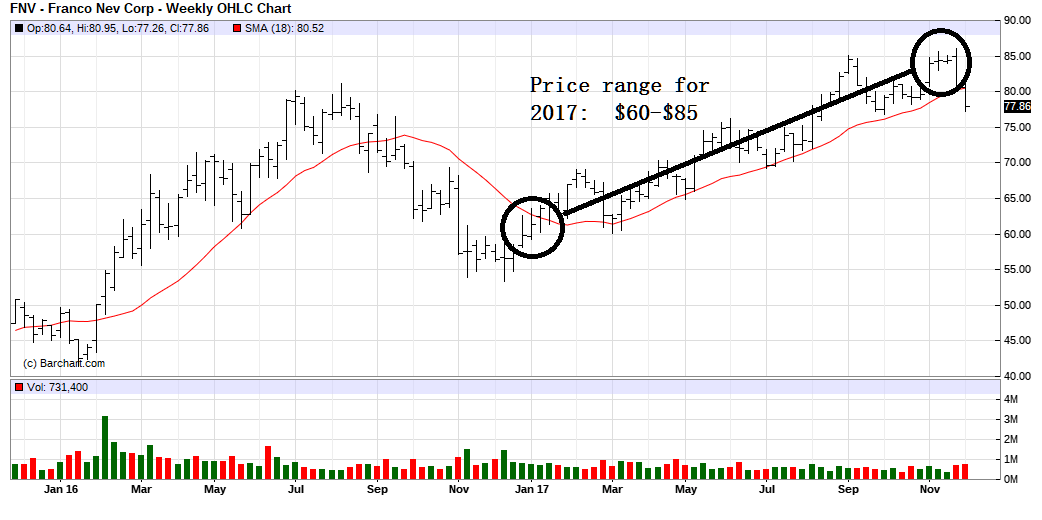

Franco-Nevada Corp – week ending December 8, 2017:

Investors made money by investing in FNV in 2017. Price moved from a low of $60 to a high of $85

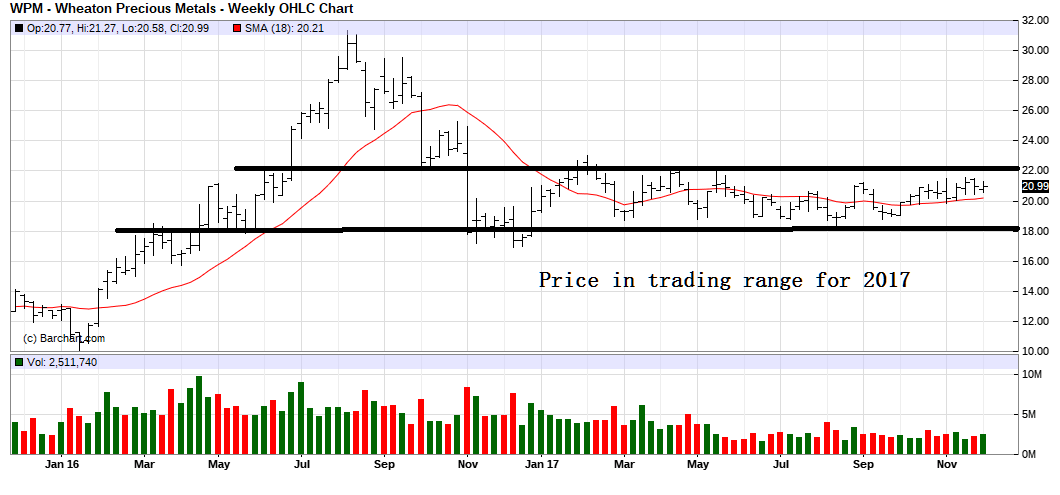

Wheaton Precious Metals – week ending December 8, 2017:

For WPM, price traded in a narrow range $18 – $22.

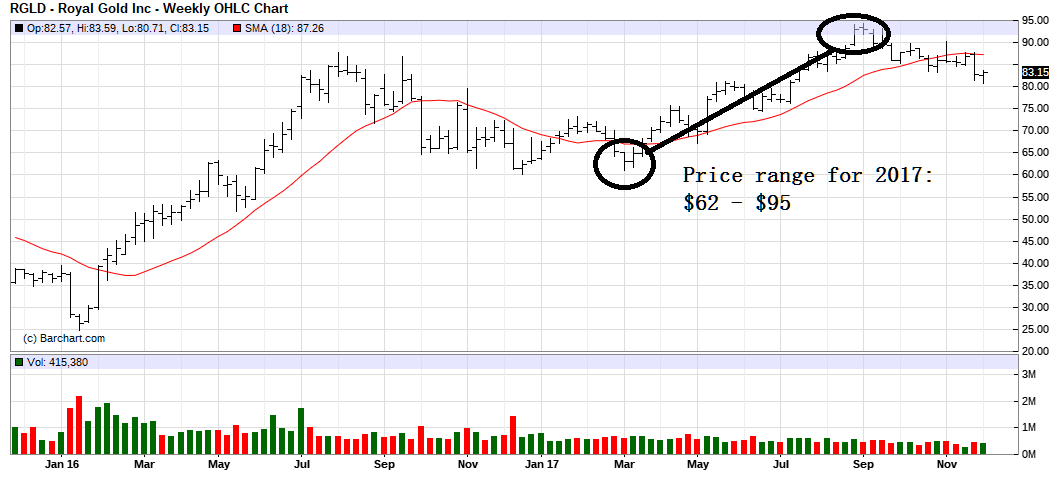

Royal Gold Inc. – week ending December 8, 2017:

Investors also made money in RGLD. Price moved from a low of $62 to a high of $95 in 2017.

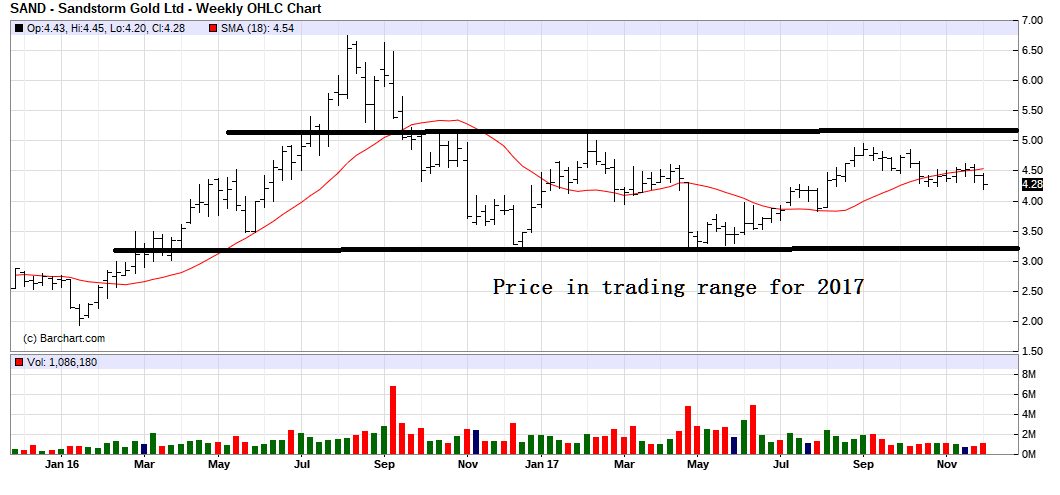

Sandstorm Gold Ltd. – week ending December 8, 2017:

Sandstorm is relatively new to the business. It has potential to grow like FNV and RGLD.

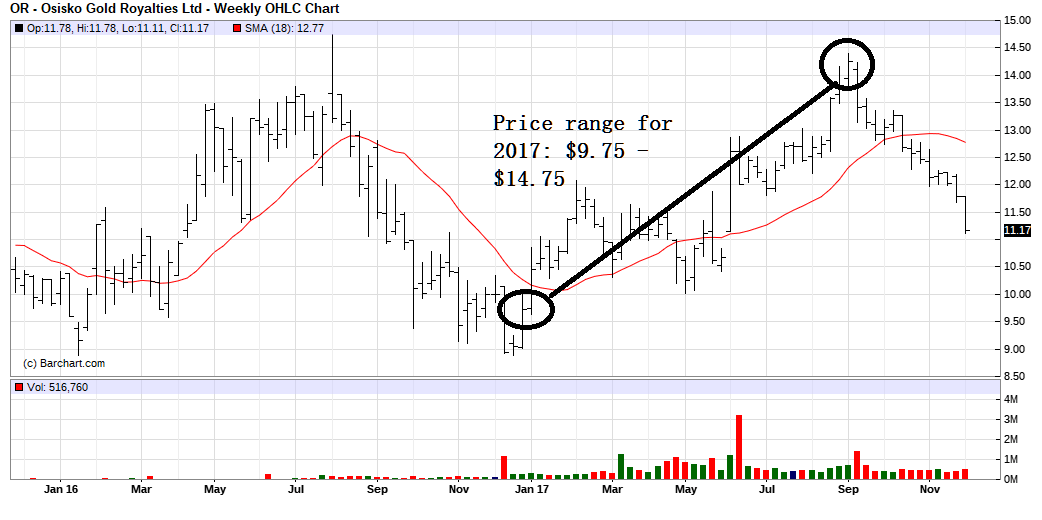

Osisko Gold Royalties Ltd. – week ending December 8, 2017:

Osisko is also a relatively new company.