Gold bullion prices and US Dollar Index review

Today the following charts are reviewed for week ending April 27, 2018:

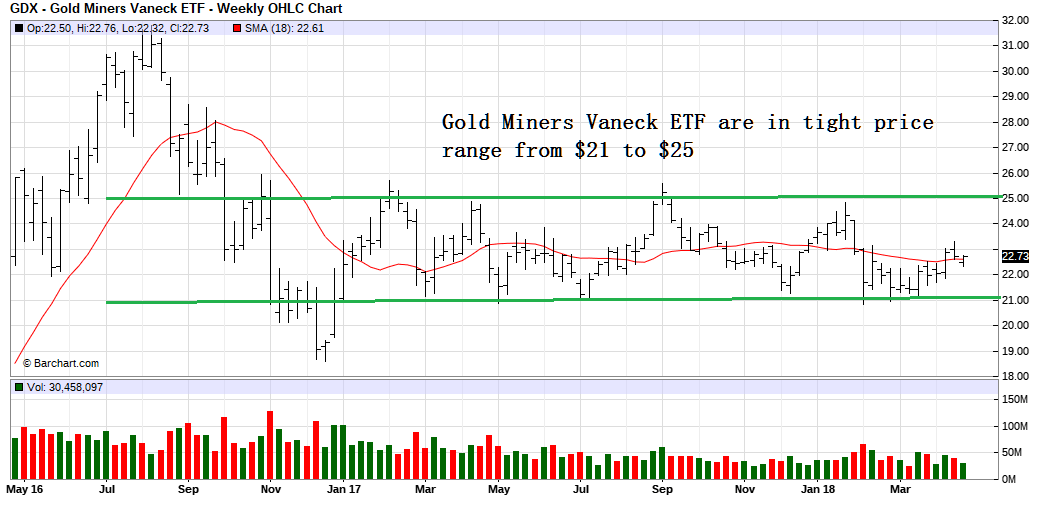

- Weekly gold futures chart – (GC)

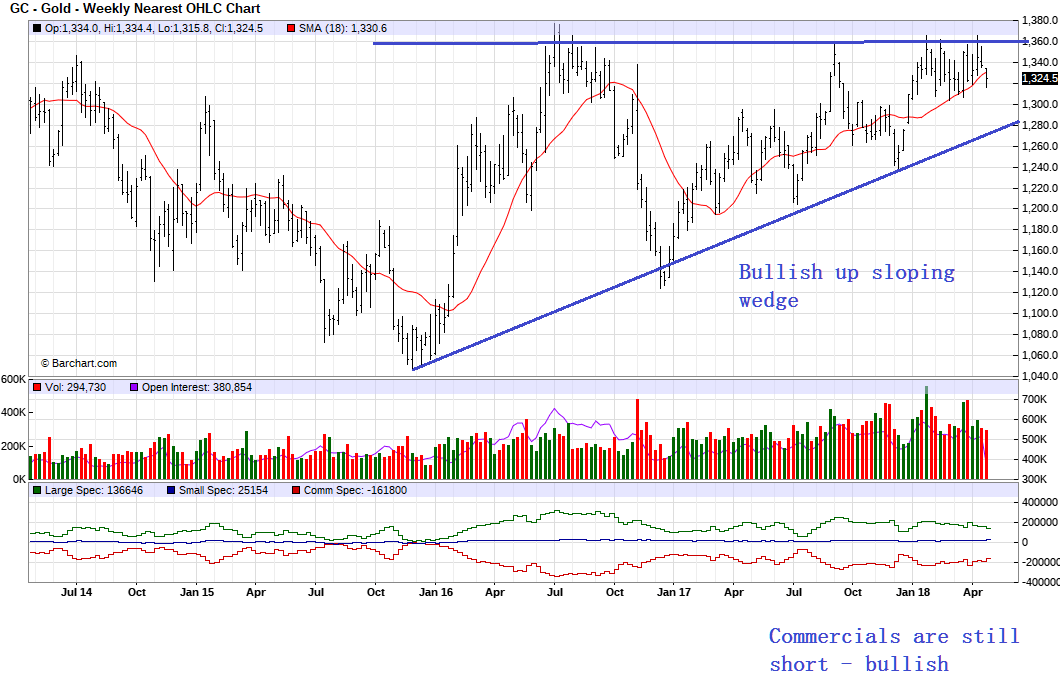

- Weekly US Dollar Index futures chart – (DX)

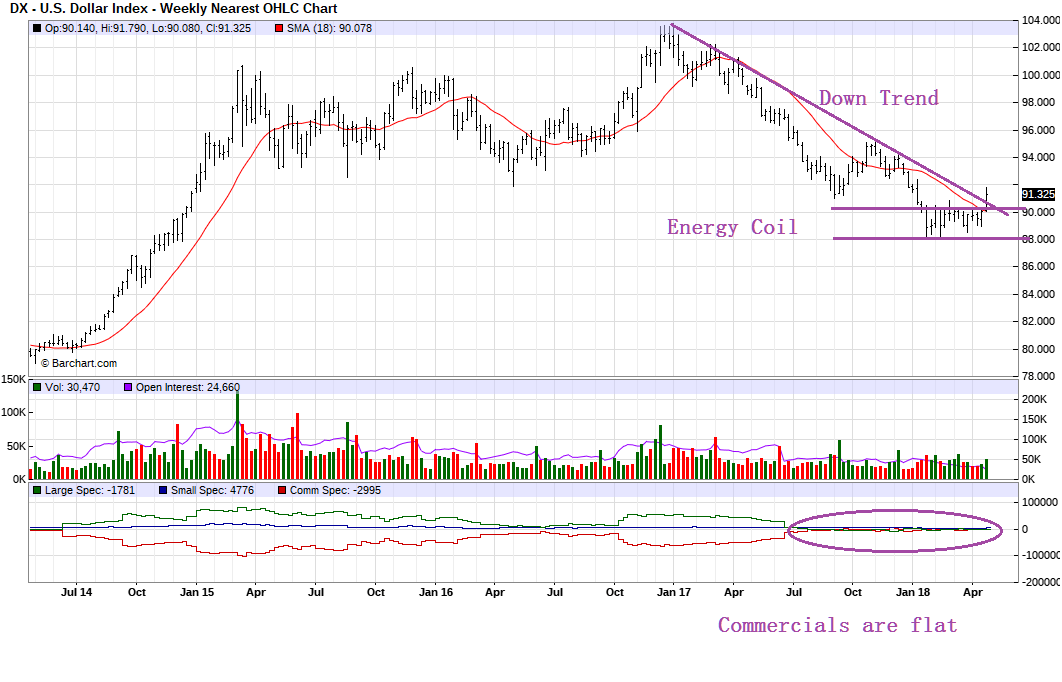

- Daily Gold ETF chart – (GLD)

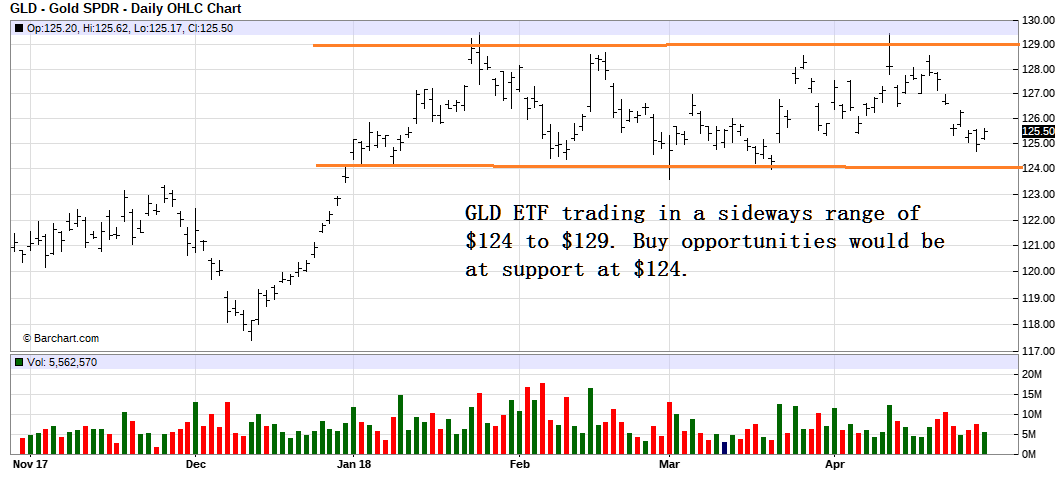

- Weekly Gold Miners Vaneck ETF – (GDX)

- Weekly gold futures (GC) chart: Prices are still in a bullish up sloping wedge. Buying opportunities would be along the up sloping trend line at about $1,300. Commercial short position remains steady at approximately 161,800 contracts.

Weekly gold futures chart – GC week ending April 27, 2018

- Weekly US Dollar Index futures (DX) chart: Prices are in a an energy coil which means that there is uncertainty as to which direction prices will move. Both commercials and large speculators are virtually flat. Large speculators are short 2,995 and commercials are short 1,781 contracts. The retail investor is on the long side with 4,776 contracts. When prices are either over bought or over sold, the retail investor is usually on the wrong side. In this case both commercials and large speculators are short.

Weekly US Dollar Index futures chart – week ending April 27, 2018

- Daily Gold ETF (GLD) chart :Gold prices on the daily chart are in a price range for most of 2018. The range is $124 to $129 per share. Buying opportunities would be along support at $124.

Daily Gold ETF price chart for week ending April 27, 2018

4.Weekly Gold Miners Vaneck ETF (GDX) chart: Gold Miners like gold ETF (GLD) have been in a price range since 2017. Price range is $21 to $25. Buying opportunities would be around support at $21.

Weekly Gold Miners Vaneck ETF price chart for week ending April 27, 2018