New Barrick Gold – long term upside for investors

Gold bars in a vaults

Barrick Gold Corporation (NYSE:ABX) and Randgold (NASDAQ:GOLD) merged at the beginning of 2019 to form Barrick (NYSE:GOLD,TSX:ABX).

The new company has a combined 78 million ounces of proven and probable gold reserves together with ownership of five the the world’s top ten Tier One Gold assets by total cash costs. According to an article in Forbes magazine (September 27, 2018) on the Barrick merger “A Tier One Gold Assets is a mine with a stated mine life of in excess of 10 years with 2017 production of at least 500,000 ounces of gold and 2017 total cash cost within the bottom half of the cash cost curve.”

In another article on the new Barrick, Barrick (NYSE: GOLD) conclude that “it makes sense to include exposure to gold as part of a well-balanced portfolio.” Further in the article the author Evan D’Silva says ”The new post-merger Barrick has a strong balance sheet and a good management structure.Its focus on improving margins makes the company attractive to own with gold at current price levels.”

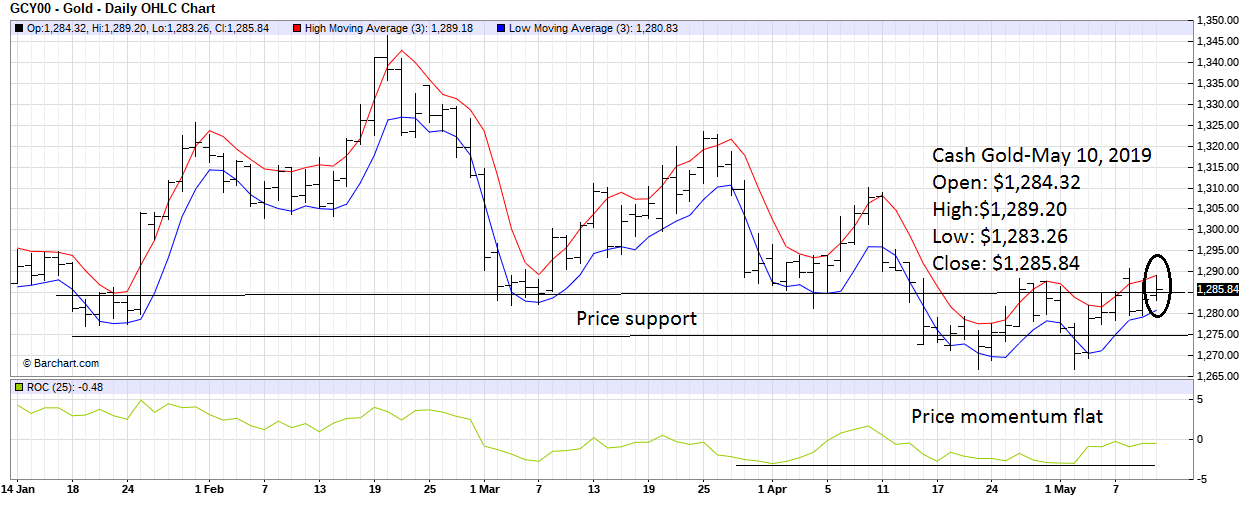

In the cash gold chart (GCY00) below gold has high price support in the range $1,175 to $1,285. Price momentum is flat which means that price will probably move sideways for a while.

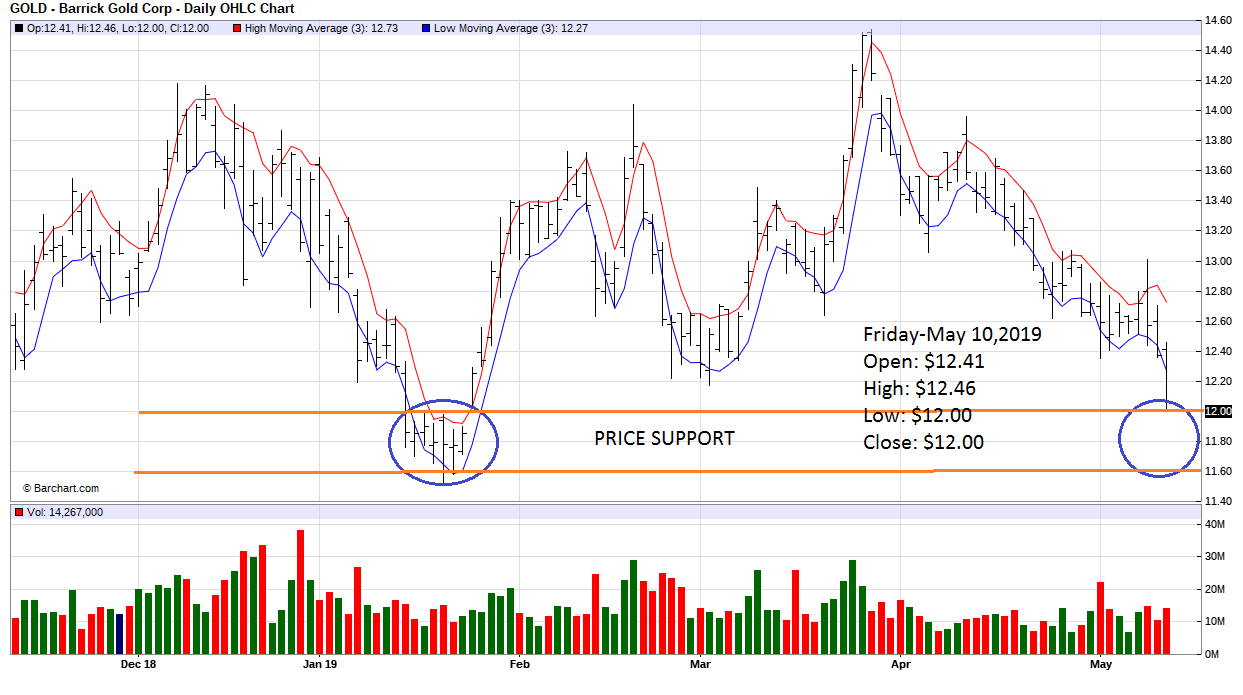

The price chart on the new Barrick (NYSE: GOLD) is shown below. On Friday, May 10, 2019 Barrick close on its low at $12.00. When price closes on its low particularly when it is in a downtrend, it usually means that price has reached its low and it will probably stabilize at this support level.