Dividend ETFs in a Low Interest Rate Environment

A low interest environment is good for stocks because more investors will be looking to invest in either stocks or ETFs. Income producing securities are also better suited for investors looking for income on a regular basis.

In a research article by O’Shares titled “The Power of a Quality Dividend Investment Strategy “ over the past ten years, dividend stocks have outperformed Value and the S&P 500. Dividend paying stocks have outperformed Value stocks in 1, 3, and 5 year periods.

In the table below is a list of ETFs that concentrate on dividend paying stocks. Most of these ETFs follow three investment principles: income, diversification and capital appreciation.

| ETF Name | Ticker Symbol | Annual Dividend | Dividend Yield |

|---|---|---|---|

| iShares Core High Dividend ETF | HDV | $3.14 | 3.27% |

| O'Shares FTSE US Quality Dividend ETF | OUSA | $0.85 | 2.38% |

| Vanguard High Dividend Yield ETF | VYM | $2.80 | 3.07% |

| Global X Super Dividend U.S. ETF | DIV | $1.77 | 7.65% |

| Investors S&P SmallCap High Dividend Low Volatility ETF | XSHD | $1.21 | 5.08% |

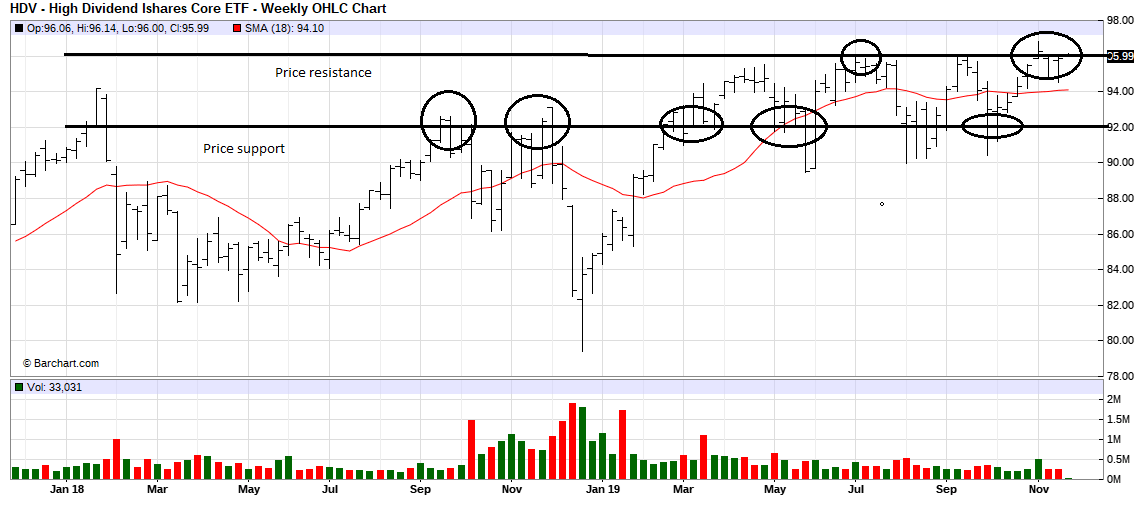

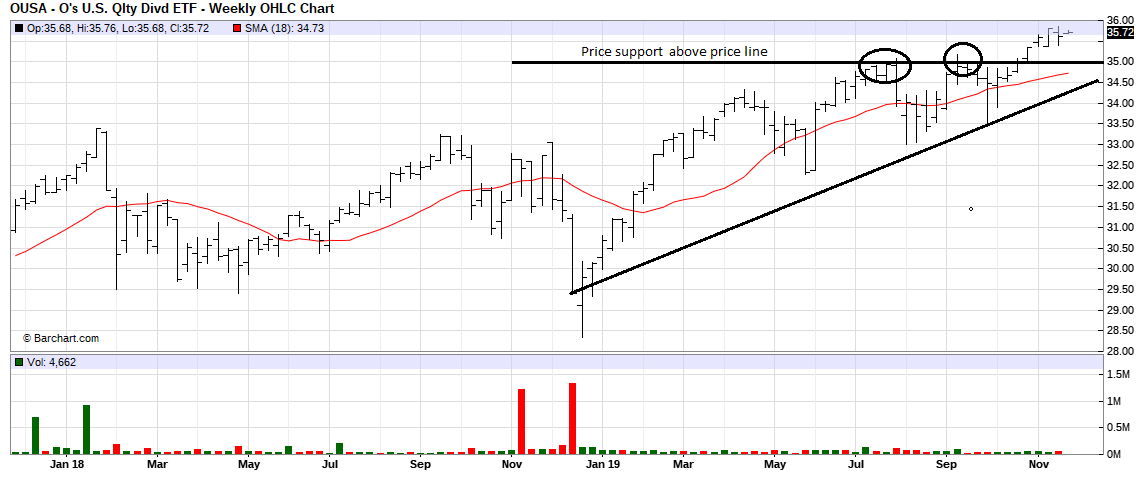

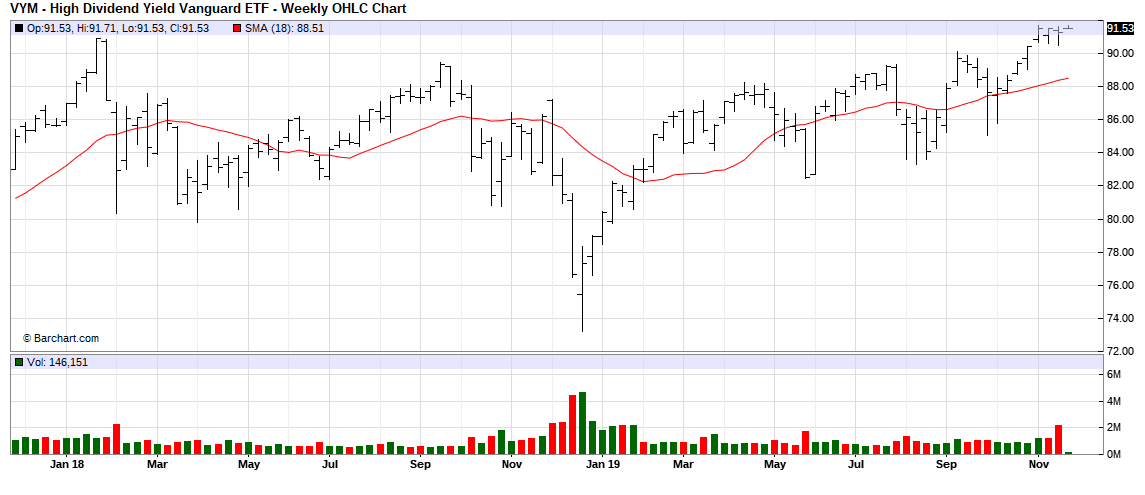

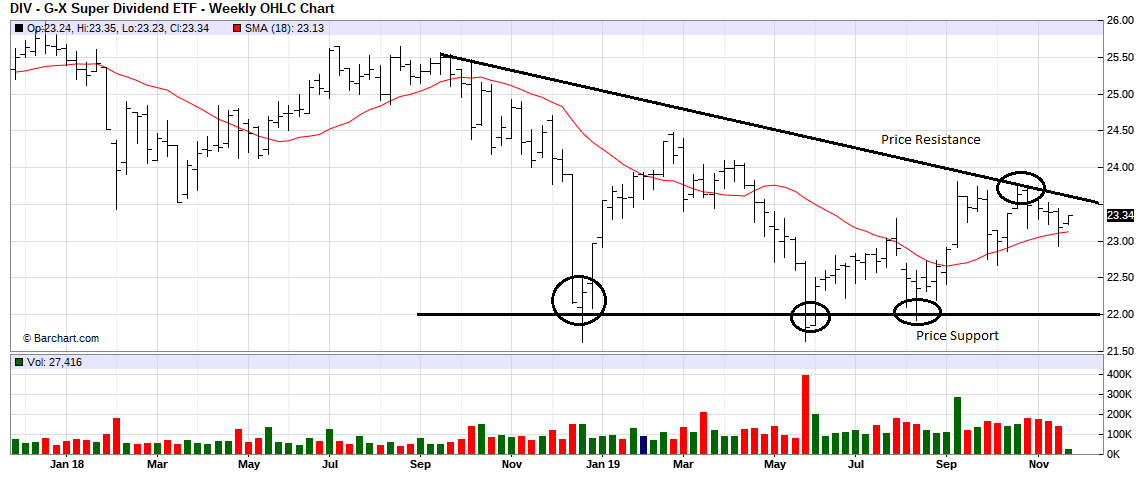

Weekly price charts shown below will give the investor an idea as to where prices are headed and where to buy ie buy at or near price support as shown on the charts.

- HDV – High Dividend ishares core ETF – weekly chart, November 25, 2019

2. OUSA -O’Shares FTSE US Quality Dividend ETF – weekly chart, November 25, 2019

3. VYM – High Dividend Yield Vanguard ETF – weekly chart, November 25, 2019

4. DIV – Global X SuperDividend US ETF – weekly chart, November 25, 2019

5. XSHD – S&P Smallcap High Dividend Low Volatility ETF – weekly chart, November 25, 2019

By adding Gold to your portfolio by just 2% to 10% of the total portfolio, you can materially reduce volatility and increase risk-adjusted returns. Gold has no counter party risk and is a safe haven in time of economic uncertainty.

To buy gold please go to GOLDBROKER.