An ETF that tracks the US Dollar Index

The PowerShares DB US Dollar Index Bullish Fund (ticker symbol: UUP) is designed for investors who want a cost effective and convenient way to track the value of the US Dollar relative to a basket of the six major world currencies. The currencies are: the Euro, Japanese Yen, British pound, Canadian dollar, Swedish krona and Swiss franc. The ETF (UUP) is a rules-based index composed solely of long US Dollar Index futures contracts that trade on the ICE futures exchange (USDX futures contracts. The USDX futures contract is designed to replicate the performance of being long the US Dollar against the six major currencies.

Since gold is quoted in US dollars, the strength or weakness of the US dollar (vis a vis the other six major currencies) will affect the price of gold. There are other factors besides the strength or weakness of the US dollar that affect the price of gold such as supply/demand, political instability, inflation and interest rates.

If an investor holds physical gold in his IRA or investment portfolio and he does not want to liquidate his gold holdings, he could either go long or short the UUP EFT to protect the decline in the price of gold.

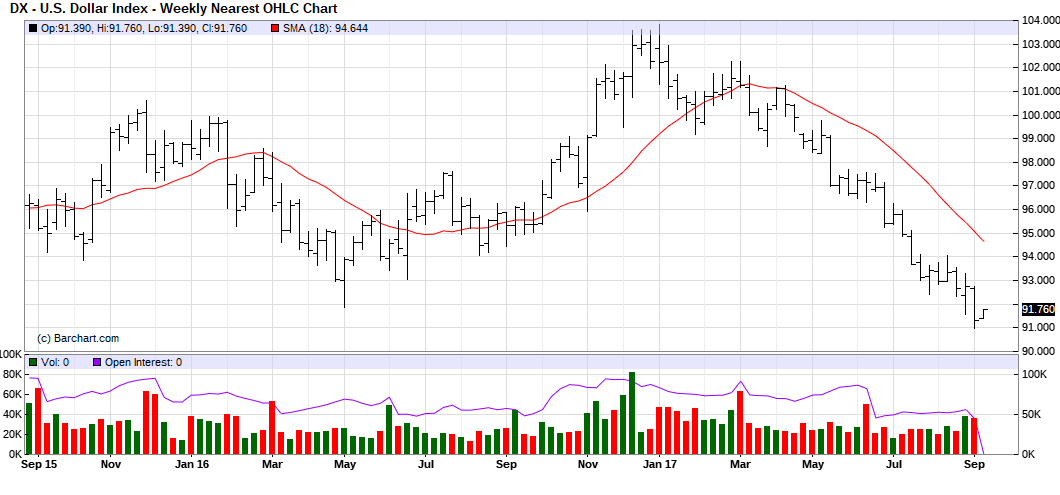

Below is a price chart of the US dollar index for WE Sept 8, 2017

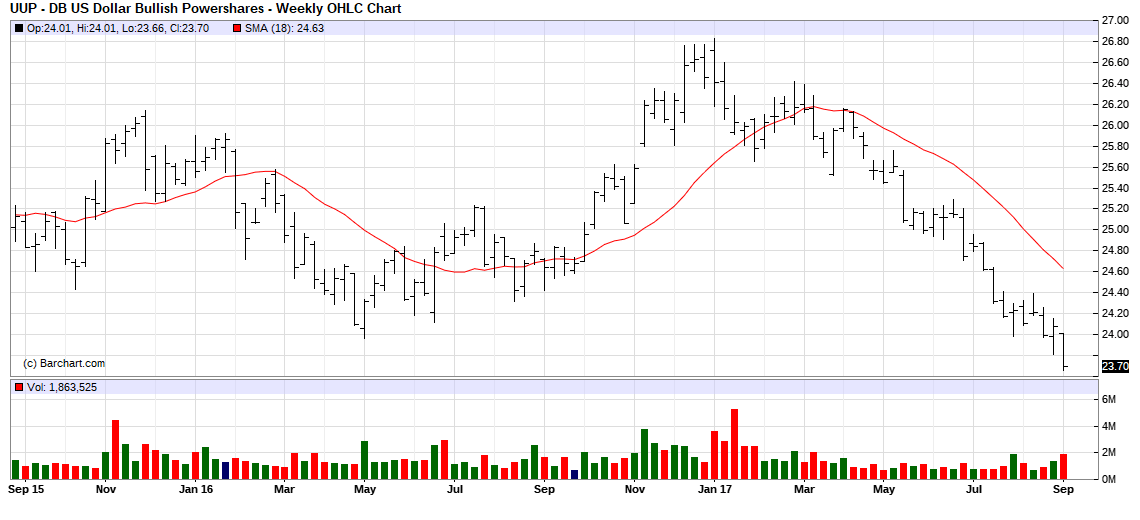

Compare the chart above to the EFT – UUP that tracks the index – WE Sept 8, 2017

As you can see, UUP tracks the US dollar index perfectly.

An Investor could therefore buy the US dollar futures index or buy the UUP EFT.

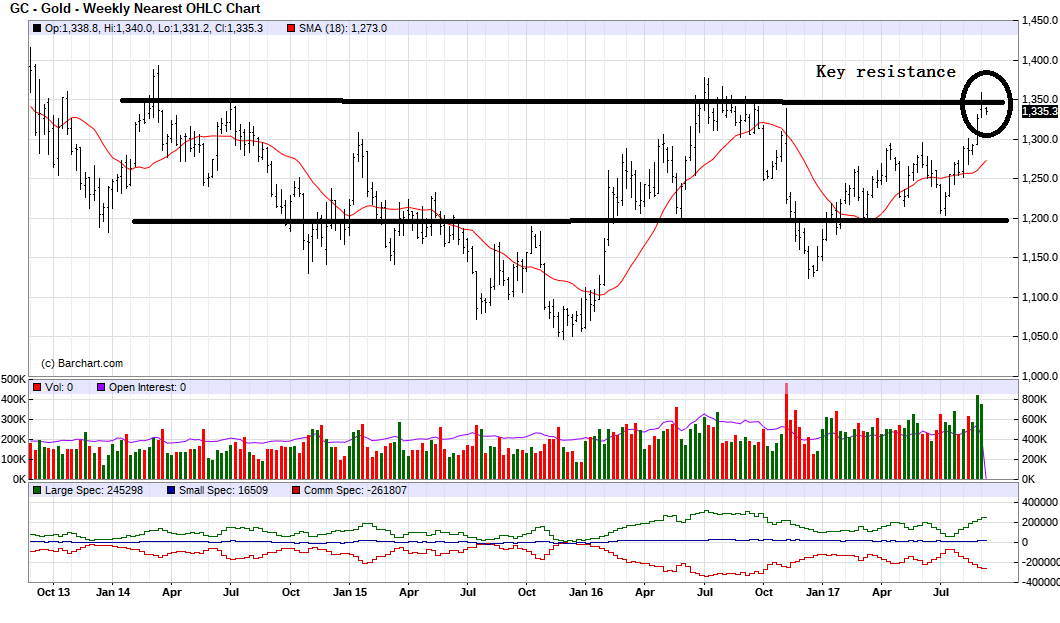

Below is an updated chart of gold futures (GC) for WE Sept 8, 2017

Key resistance is at $1,350 per oz. Expect price to hover around this level before trending.