Follow the smart money in gold

Futures trading/hedging is a zero sum game. Whenever a group or trader makes money, someone or some group has lost an equivalent amount of money.

The COT report shows three main trading groups:

- Commercials – these are the hedgers/producers

- Large speculators e.g. hedger funds

- Small speculators e.g retail traders.

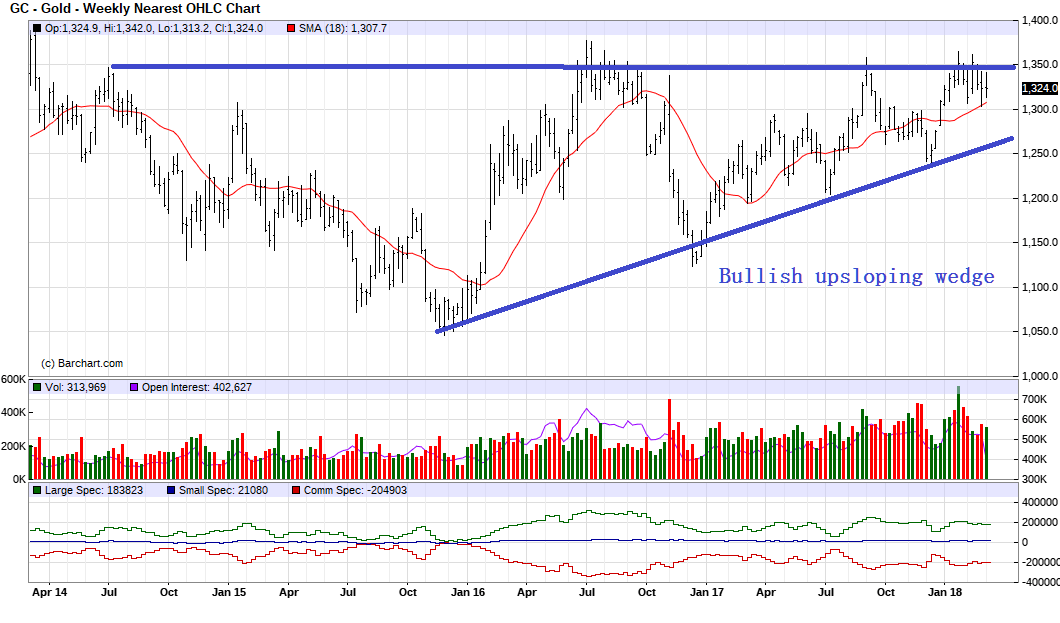

The COT report shown at the bottom of the gold weekly futures chart (week ending March 10, 2018) shows:

- Commercials – net short 204,903 contracts

- Large speculators – net long 183,823 contracts

- Small speculators – net long 21,080

Normally, in an uptrend commercials will short the market. Commercials will sell futures contracts if the price is higher than their cost of production. By selling futures contracts they will be locking their sales prices in the future. For example if the price of gold is trading at $1,324 per ounce and the cost of production is $1,050 per ounce, it would make sense to sell gold futures contracts to lock in prices.

The gold futures chart for week ending March 10, 2018 shows a bullish up sloping wedge i.e. it looks like prices will be trending up in the future.

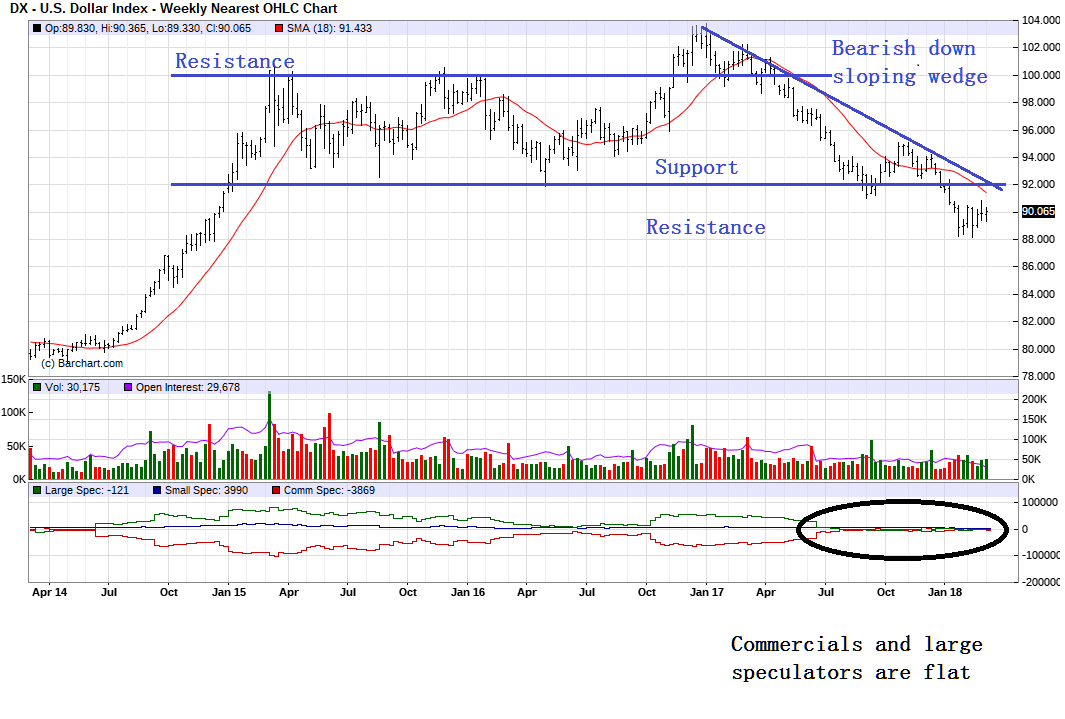

Since gold is quoted in US dollars, if the dollar strengthens against other currencies, the price of gold will weaken and conversely if the dollar weakens, gold will go up. That is why a daily review of the dollar is helpful in getting a insight into where gold will be heading.

In the US dollar index chart (week ending March 10, 2018) above, the US dollar just broke out of its trading range ($100 – $92). Price may test the $92 level before weakening.

The COT report for the US dollar shows:

- Commercials – net short 3,869 contracts

- Large speculators – net short 121 contracts

- Small speculators – net long 3,990 contracts

Normally, when prices are oversold or overbought, the small speculator is usually on the wrong side. In this case, prices are not yet oversold. Small speculators are the largest group in a net long position (3,990 contracts) while the commercials have taken the other side. Large speculators remain on the sidelines. Based on the net position taken by the small speculator, they speculate that the US dollar will strengthen. The expectation for 2018 is that the FED will increase interest rates this year which is good for the US dollar. Large speculators seem uncertain as to where the US dollar is heading (net short 121 contracts).