Is there Gold in Junior Gold Miners for investors?

Photo: Can Stock

Photo: Can Stock

Mining companies are classified into two categories: juniors and majors. Majors are large companies that mine and sell the deposits (gold) while juniors search for deposits. Once the deposits are found, juniors usually partner or sell out to the majors.

There are two ETF junior gold miners listed on the NYSE ARCA exchange – VanEck Vectors Junior Gold Miners ETF (ticker symbol: GDXJ) and Sprott Junior Gold Miners ETF (ticker symbol: SGDJ).

VanEck GDXJ is modeled after the MVIS Global Junior Gold Miners Index (MVGDXJTR). The index tracks the overall performance of small-cap companies involved in gold/silver mining. As of October 31, 2017 there were 74 companies in the Index. Balancing is done quarterly.

The MVIS Global Junior Gold Miners Index includes companies that generate at least 50% of their revenue from both gold and/or silver when developed. GDXJ is more globally spread out than Sprott SGDJ which is more focused on North America. See table below.

MVIS Global Junior Gold Miners Index – country weightings:

| Country | % - Oct 31, 2017 |

|---|---|

| Canada | 54.44 |

| Australia | 17.37 |

| South Africa | 9.47 |

| United States | 9.39 |

| United Kingdom | 3.54 |

| China | 1.95 |

| Monaco | 1.85 |

| Peru | 1.00 |

| Turkey | 0.76 |

| Total | 99.77 |

The Sprott Junior Gold Miners ETF follows the Sprott Zacks Junior Gold Miners Index (NYSE:ZAXSGDJ). Each stock weighting in the index is adjusted based on two company factors: 1) Revenue Growth and 2) Price Momentum. The index picks gold stocks with a market capitalization between $250 million and $2 billion. As at September 30, 2017 there were 36 companies in the index. Balancing is done semi-annually.

Sprott Zacks Junior Gold Miners Index – country weightings:

| Country | % - Sept 30, 2017 |

|---|---|

| Canada | 81.34 |

| United States | 8.03 |

| Monaco | 6.65 |

| South Africa | 2.19 |

| China | 1.79 |

| Total | 100.00 |

For the active investor looking to buy individual junior gold mining stocks, you can look at the composition of the indexes. Below is a list of junior mining stocks that are in both VanEck and Sprott ETFs. These ETFs are narrowly focused and are highly dependent on the price of gold. Other risk factors include:

- Risk of investing in small and medium cap companies

- Equity securities risk

- Market risk

- Operational risk

- Index tracking risk

- Authorized Participant Concentration risk

- No guarantee of Active Trading Market

- Trading issues – share may be halted on the NYSE ARCA due to market conditions.

Top 5 holdings of VanEcK Vectors Junior Gold Miners ETF (Ticker: GDXJ) as at October 31, 2017:

| Holding Name | Ticker | % of Net Assets |

|---|---|---|

| Gold Fields Ltd. | GFI.US | 4.15 |

| Sibanye Gold Ltd. | SBGL.US | 3.91 |

| Pan American Silver Corp. | PAAS.US | 3.90 |

| Kirkland Lake Gold Ltd. | KL.CN | 3.78 |

| Iamgold Corp. | IAG.US | 3.78 |

| Top 5 total (%) | 19.52 |

Top 5 holdings of Sprott Junior Gold Miners ETF (ticker: SGDJ) as at September 30, 2017:

| Holding Name | Ticker | % of Net Assets |

|---|---|---|

| Iamgold Corp. | IAG.US | 10.26 |

| New Gold Inc. | NGD.A | 7.94 |

| Centerra Gold Inc. | CG.CN | 7.66 |

| Alamos Gold Inc. | AGI.US | 7.50 |

| Kirkland Lake Gold Ltd. | KL.CN | 7.41 |

| Top 5 total (%) | 40.77 |

Picking individual junior gold mining stocks is always risky and should be left to investors who have speculative funds that they can lose without affecting their lifestyle or standard of living. According to the World Gold Council, “On average, it takes between 10-20 years before a mine is even ready to produce material that can be refined.”

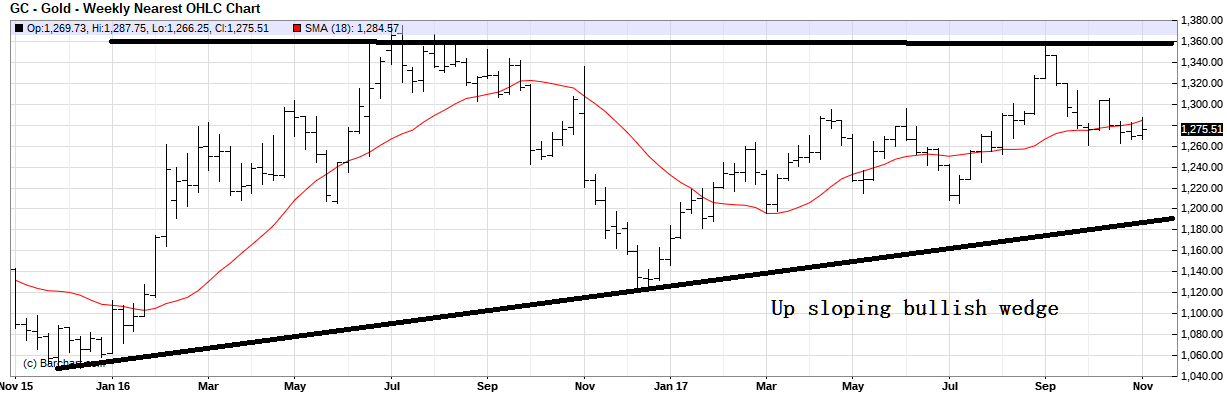

Below is an updated weekly chart of cash gold “GC” for Week Ending November 10,2017:

Gold price is in a sideways movement within a bullish up sloping wedge. Gold may move to the upside once it breaks resistance ie above $1,360.

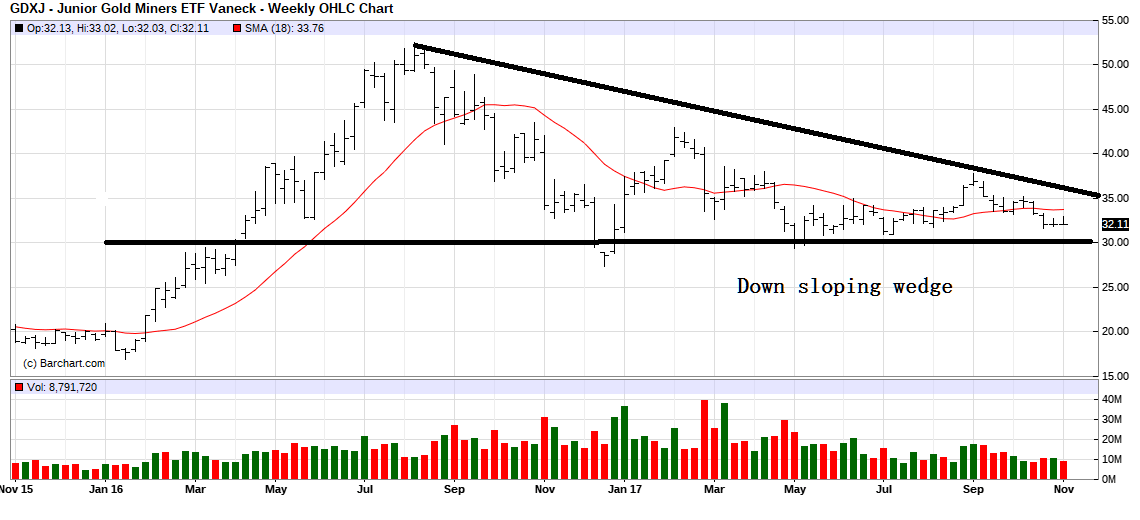

Below is a weekly price chart of VanEck Vectors Junior Gold Miners ETF (Ticker: GDXJ) for Week Ending November 10, 2017:

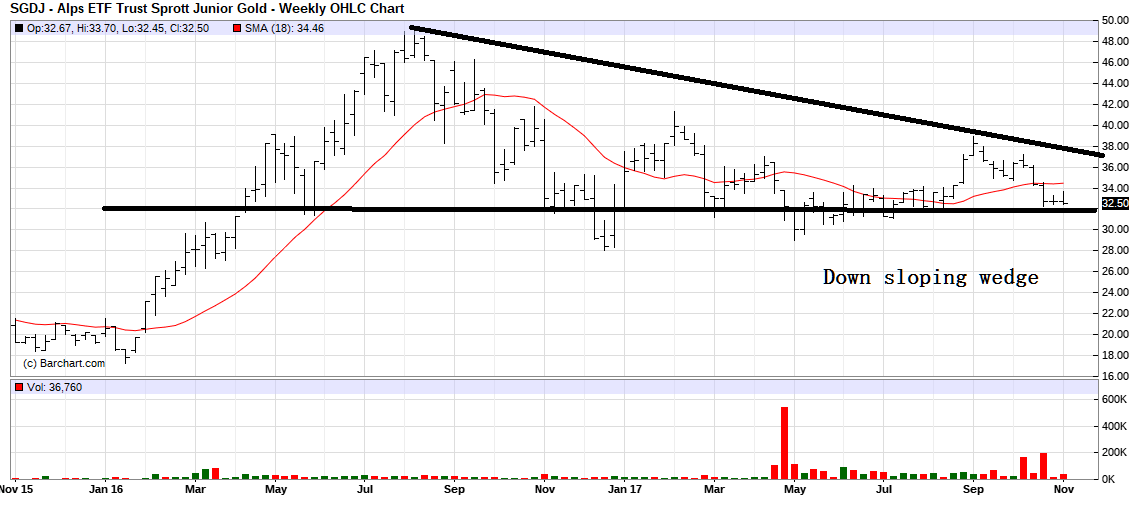

Below is a weekly price chart of Sprott Junior Gold Miners ETF (Ticker: SGDJ) for Week Ending November 10, 2017:

In conclusion, investors looking for additional exposure to gold should look at junior gold miners ETF. Both VanEck and Sprott provide decent exposure to juniors that are above the early stage exploratory stage.